Real Info About How To Reduce Deferred Tax Liability

This results in a deferred tax liability of rs.

How to reduce deferred tax liability. These accounts allow you to defer taxes on. With a 1031 exchange, you’re kicking the can down the road basically,. Certain tax incentives will create a deferred tax liability journal entry, giving the business some temporary tax relief, but will be collected later.

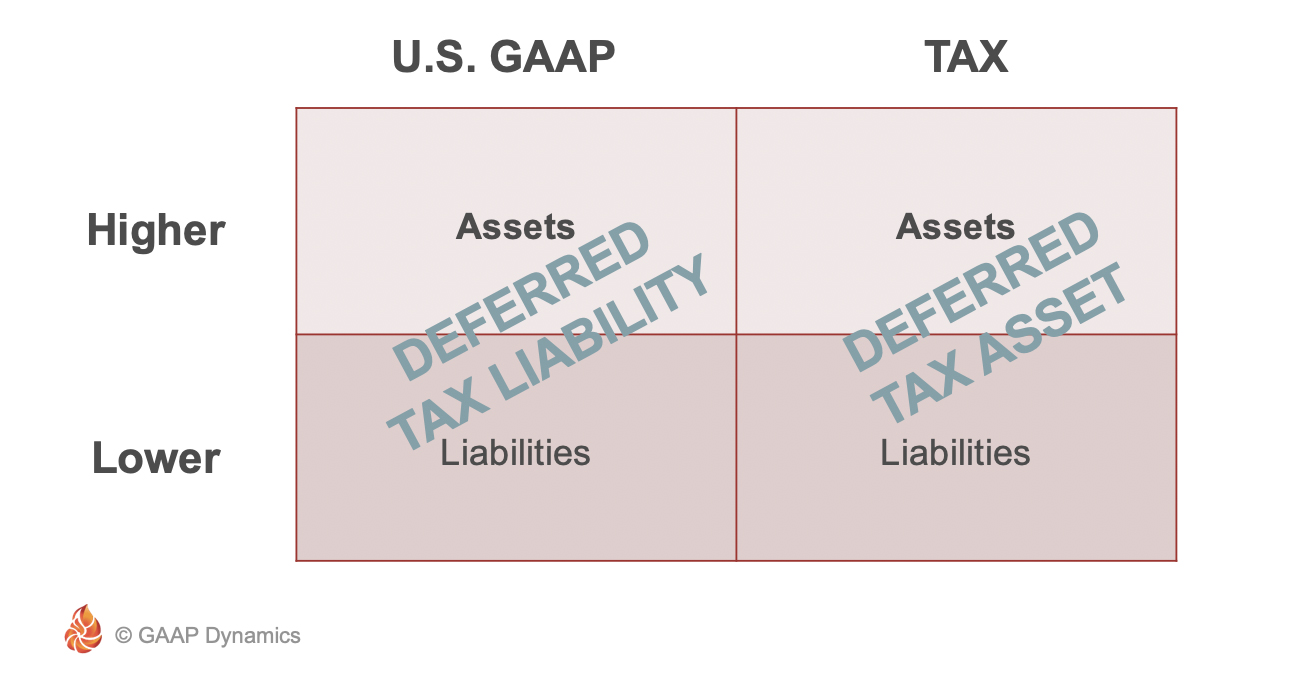

Valuation allowances reduce deferred tax liabilities to the amount that is more likely than not to be payable in the future. In real estate, one of the most common forms of deferring tax liability is the 1031 exchange. Therefore, it cannot be based on a fair value of an asset.

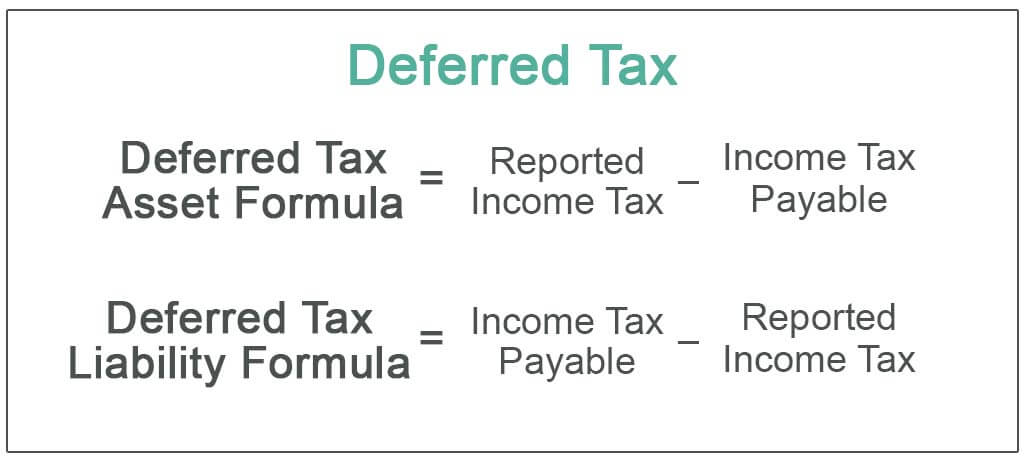

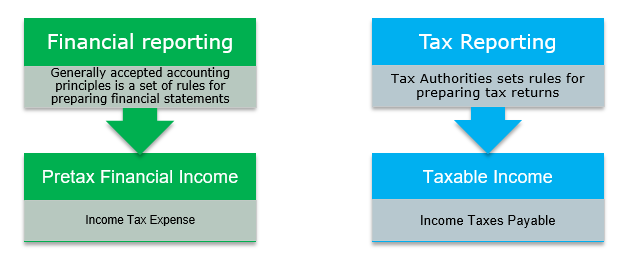

Deferred tax liability is calculated by finding the difference between the company's taxable income and its account earnings before taxes, then multiplying that. Changes in enacted tax rates that do not become effective in the. Can you reduce the deferred tax provision by the value of the taxable loss.

How can a business reduce tax liability? The measurement of deferred tax is based on the carrying amount of the assets and liabilities of an entity (ias 12.55). It must adjust the dtl as per the change in the tax rate.

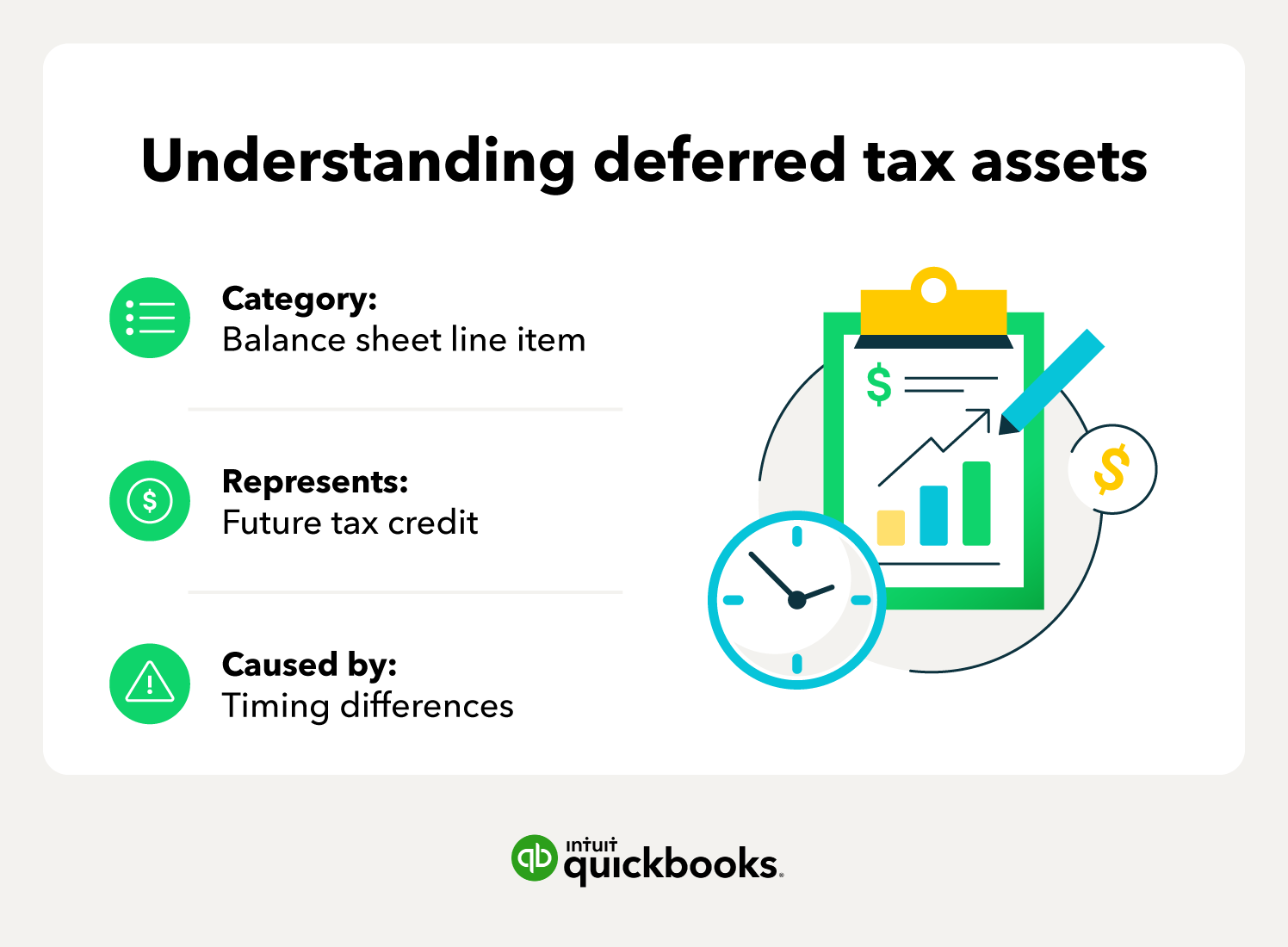

Additionally, a deferred tax asset can result from an income tax credit, loss carryover or other tax attribute that is available to reduce future income tax obligations.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)