Brilliant Strategies Of Tips About How To Maintain Good Credit Score

9 tips for maintaining a good credit score 1.

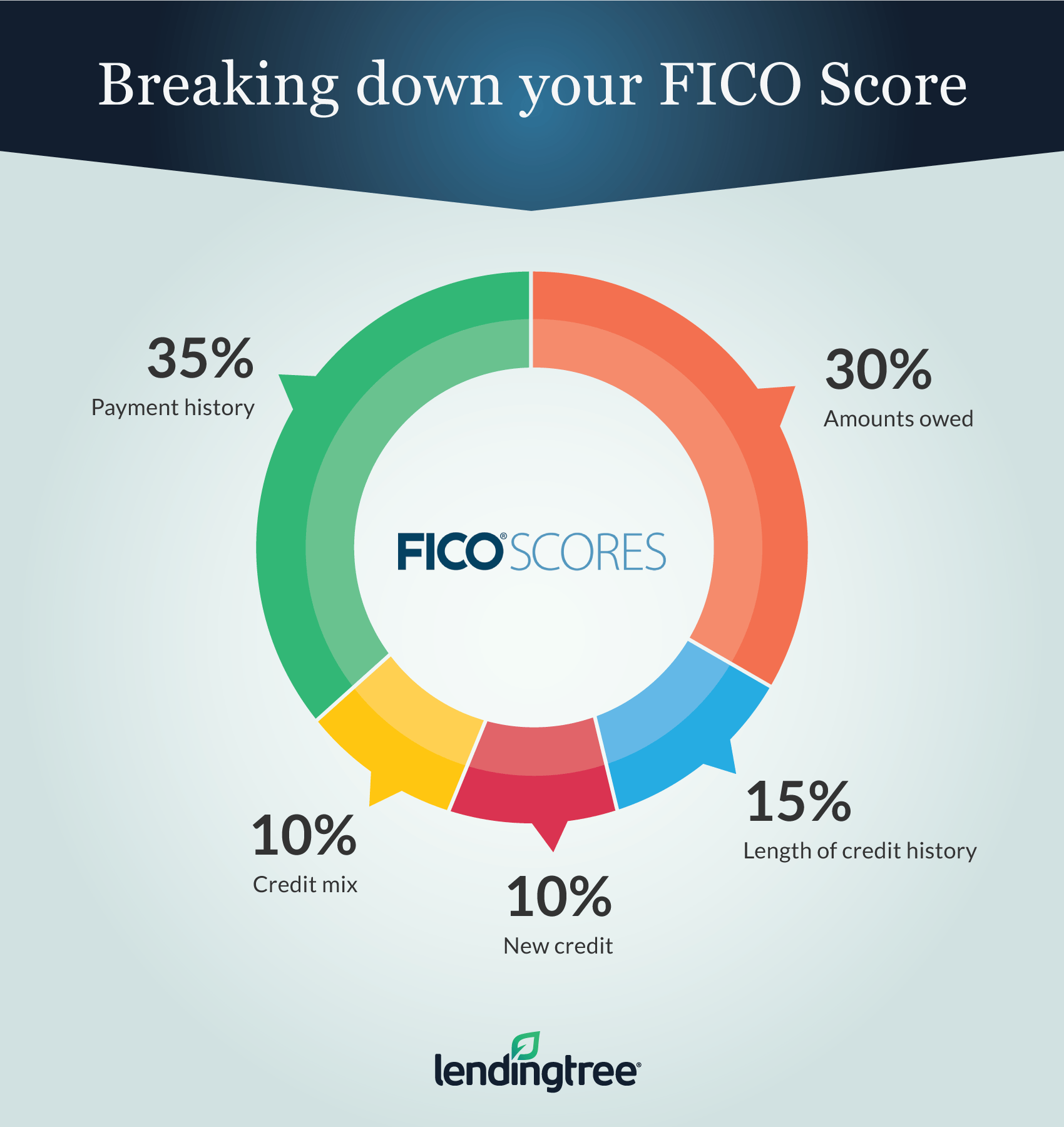

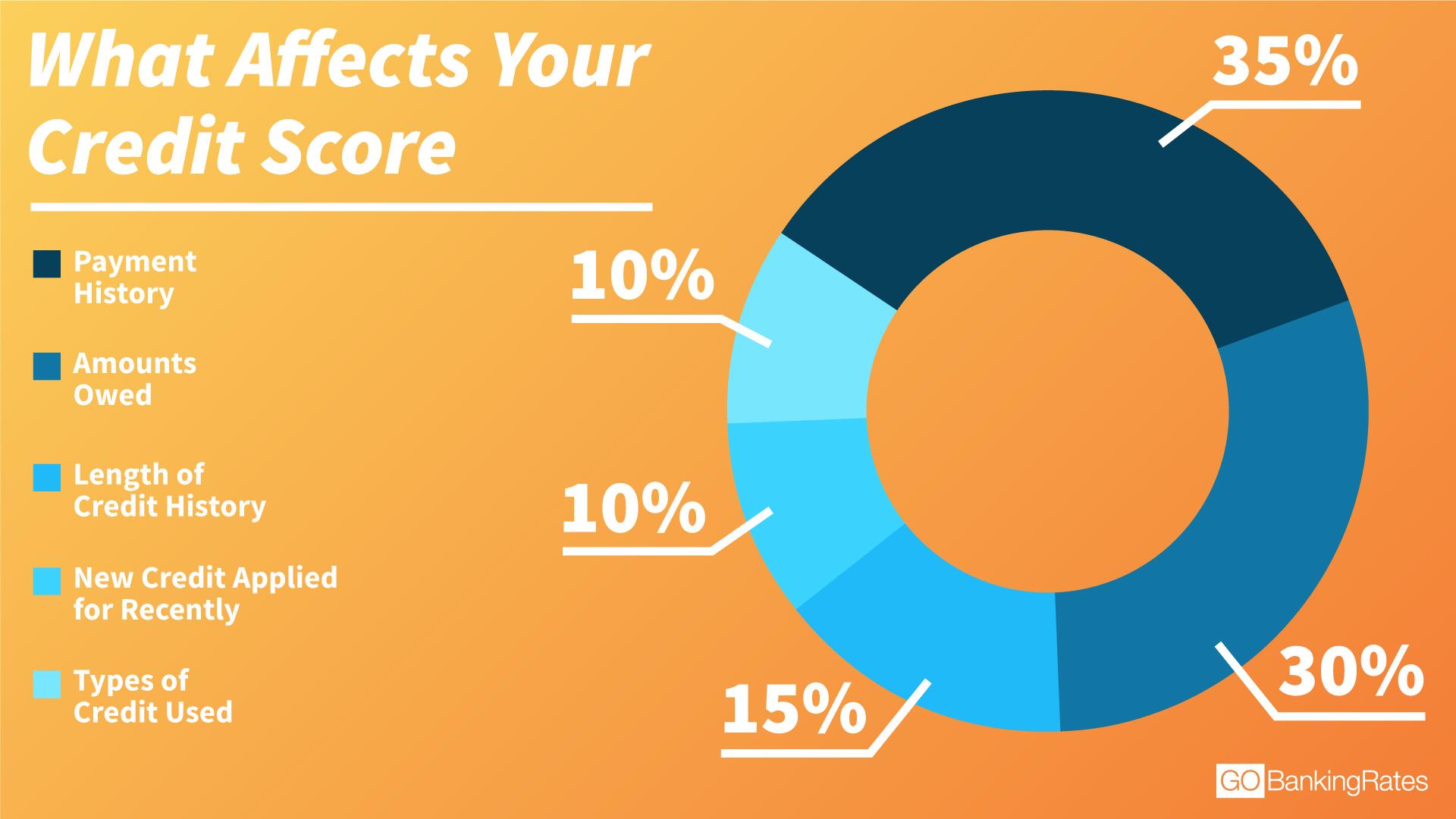

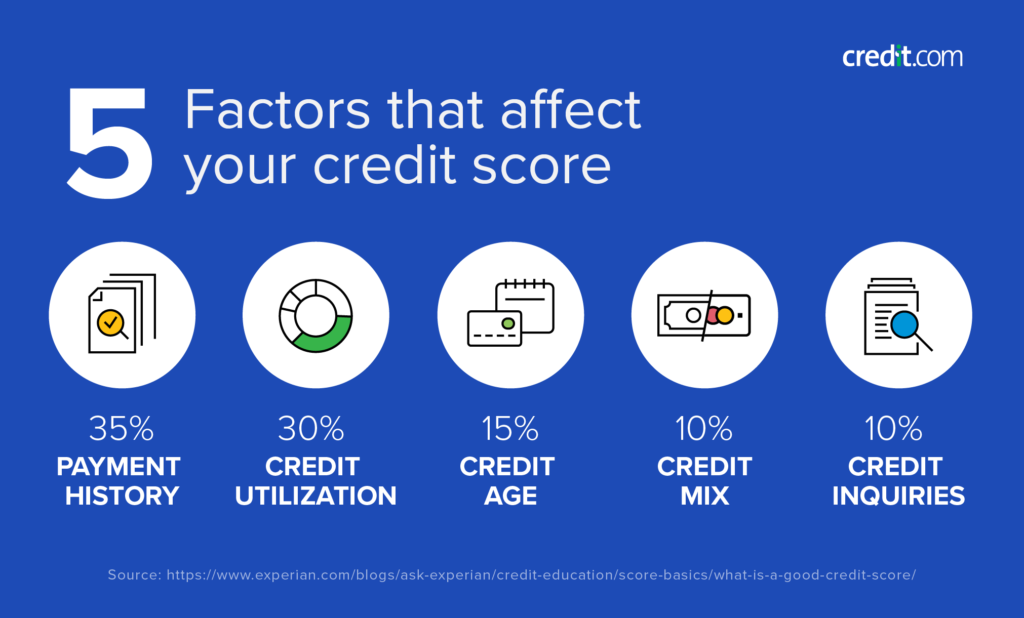

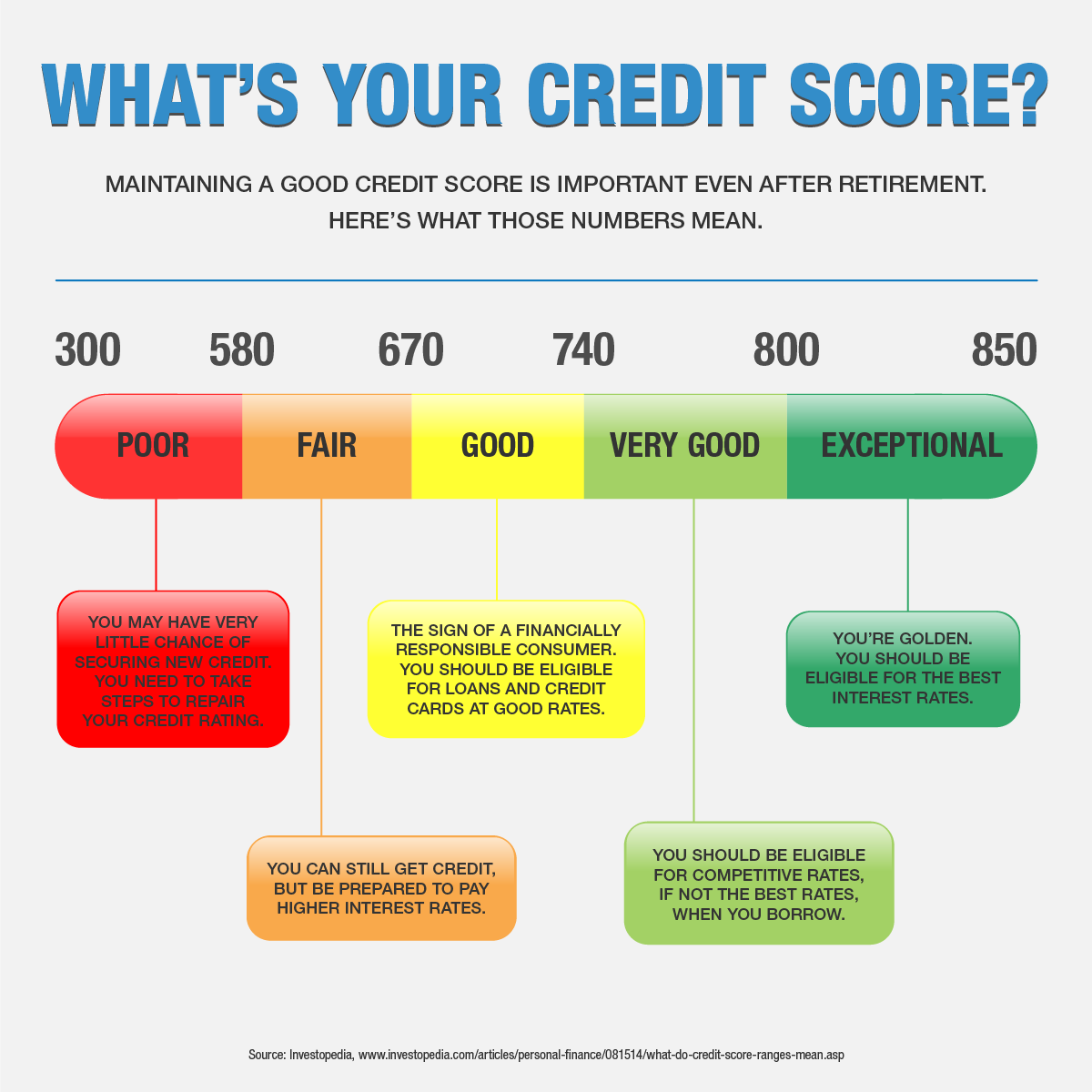

How to maintain good credit score. So if you can spend a maximum of $100 on your credit card (your credit limit), that means you shouldn’t have a. A fico score ranges from 300 to 850, with 300 indicating a “poor” or low score and 850 indicating an “excellent” or high score. A good payment history is the most important factor in your credit score.

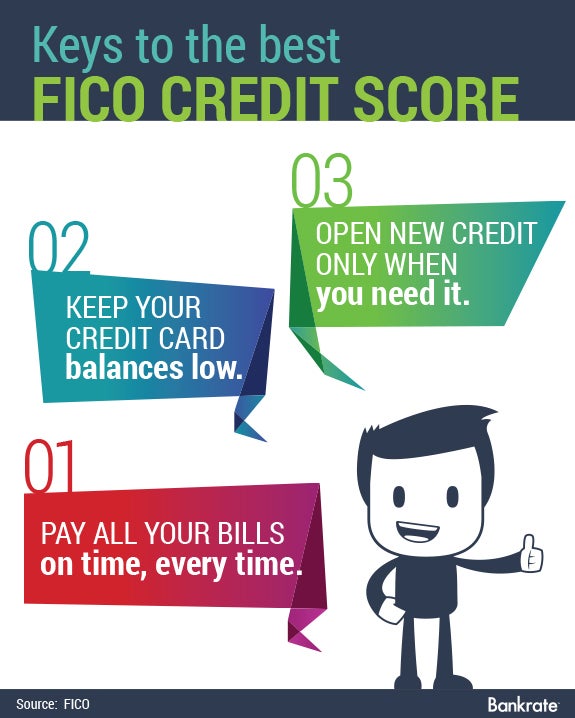

Keep old credit cards open to maintain a. Find a card offer now. Apply today & payoff your debt

A fico score of at least 670 is generally regarded. You can improve your credit utilization by paying down balances and by. Use credit wisely one more tip for maintaining a good credit score is to use credit wisely.

Bring down your credit utilization ratio. This refers to the amount of available credit you. Contents [ hide] 1 pay all bills on time.

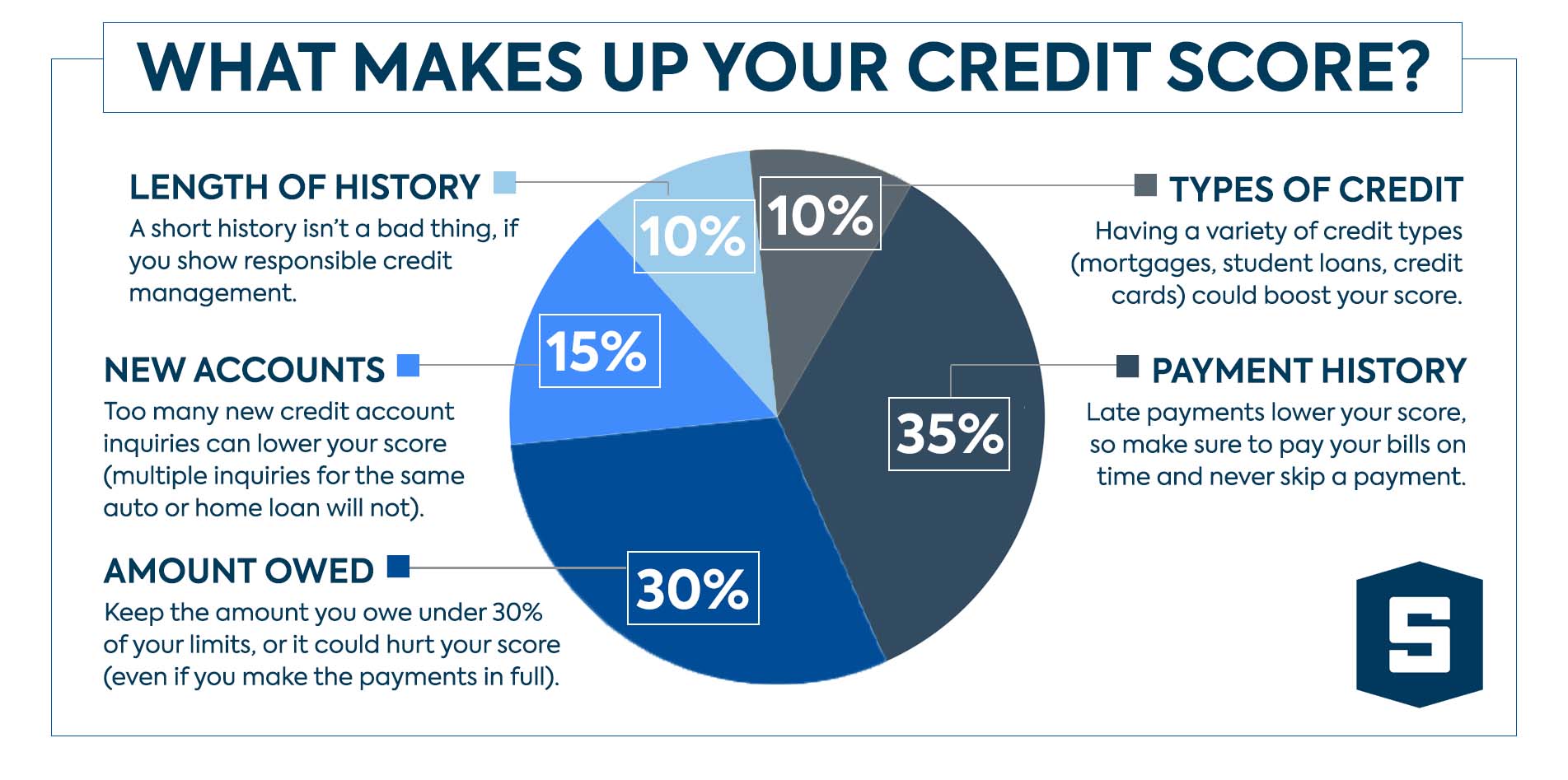

Now that you know what affects your credit score, how to maintain a good, very good, or excellent credit rating should be pretty straightforward: Treat all of your debts equally when it comes time to pay 2. Since payment history is the most heavily weighted factor in your score, never missing a payment is the most important way to maintain good credit.

Here are my top tips for keeping up your credit score. With your payment history determining 35% of your overall score, paying your bills on time is essential. See our top 5 rated services and improve your credit score.

:max_bytes(150000):strip_icc()/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)