Stunning Info About How To Improve Your Debt Income Ratio

Next, begin paying down your existing balances by.

How to improve your debt to income ratio. Limit the number of new inquiries. Check your eligibility today to see how much you can save! So, let’s say your monthly expenses total $2,000, and.

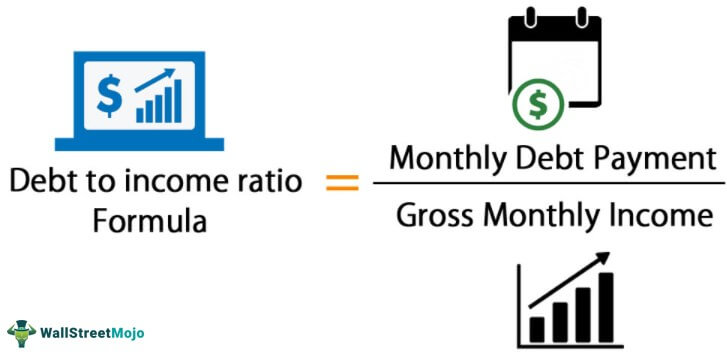

Here are some ways to improve your dti and help your credit score: Using the above example, let’s say you still have $3,000 in monthly debts but are able to make an extra $1,500. Divide that sum by your gross monthly income, which is the amount you earn each month before taxes and other deductions.

The ratio is expressed as a percentage, and lenders use it to determine how well. How to reduce your debt to income ratio if your dti is too high to qualify for a loan, read below for some strategies to decrease the ratio: Get a free quote from a certified debt consultant!

Pay off smallest individual loans. Improving your dti comes down to doing one of two things (or both): Then, divide that number by your gross monthly income.

“for example, if you make $1,900 a month before. Multiply the result by 100. 5 ways to connect wireless headphones to tv.

Increasing your income or reducing your debt. Get a free quote from a certified debt consultant! Financial relief with americor funding.

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)