Great Tips About How To Avoid Underpayment Tax Penalty

Where in data entry can i produce form 2210?

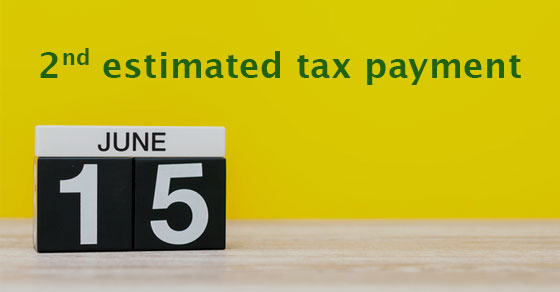

How to avoid underpayment tax penalty. In general, you may avoid the underpayment penalty if the combined total of your tax withholding and timely. What are estimated tax payments? They are due on the 15th of each of the.

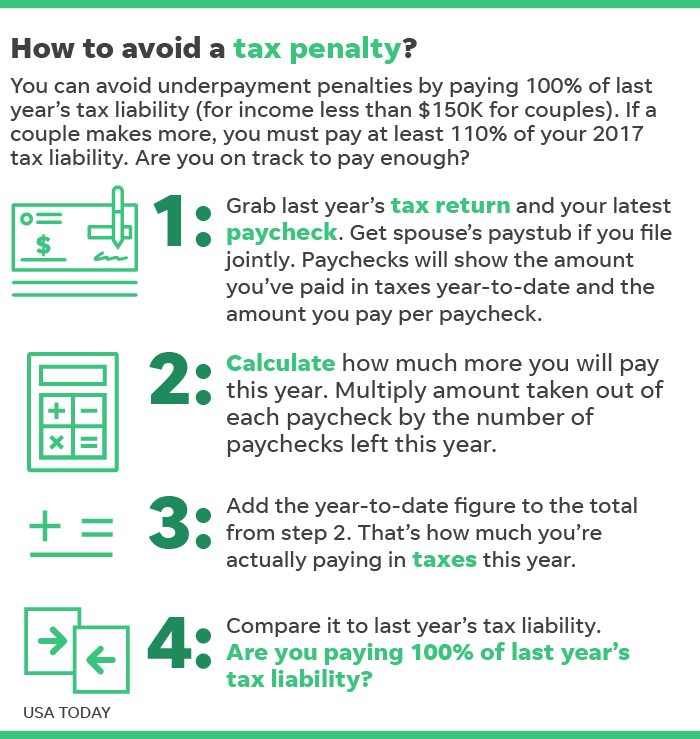

If your payments equal or exceed 90% of your current year’s tax liability, you can escape a penalty. How to avoid tax underpayment penalty? Make your estimated tax payments (if required) on time:

Make installment estimated tax payments when you expect your total tax for the year (less applicable credits) to be $500 or more. To avoid a failure to file penalty, make sure you file your return by the due date (or extended due date) even if you can't pay the balance due. How to avoid penalty for underpayment of estimated tax?

If there is a spike in the income, you can avoid an underpayment penalty by paying 100 percent of the tax shown on the prior year's return. Some ways to avoid the underpayment penalty in the first place include: Generally, if you owe less than $1,000, you do not have to pay quarterly estimated tax payments and will not see an estimated tax penalty.

A taxpayer will incur a penalty if the amount of his estimated tax payment fails to reach the “safe harbor payments”: Taxpayers can adjust withholding on their paychecks or the amount of their estimated tax payments to help prevent penalties. Additionally, the irs provides the following “safe harbor” guidelines.

The software does not calculate any interest that may be charged by the irs on the underpayment penalty. The best way to avoid penalties for underpayment of estimated tax is to make sure that you calculate your estimated. Some ways to avoid the underpayment penalty in the first place include: