The Secret Of Info About How To Avoid A Short Sale

Your lender has to approve the.

How to avoid a short sale. Banks (short sale lenders) expect offers on short sales to come in at as close the appraised value as possible. If you give the lender a reason to believe that this. Because bankruptcy stops the foreclosure process cold , the lender.

“lots of times, people want to live near relatives. The most common short sale mistakes are 1) not inspecting the property. Wonderful 1st floor condo in mcgehee estates!

How to avoid nightmare #1: Assemble a dream team to get you through this tough process. The bank now stands between you and the.

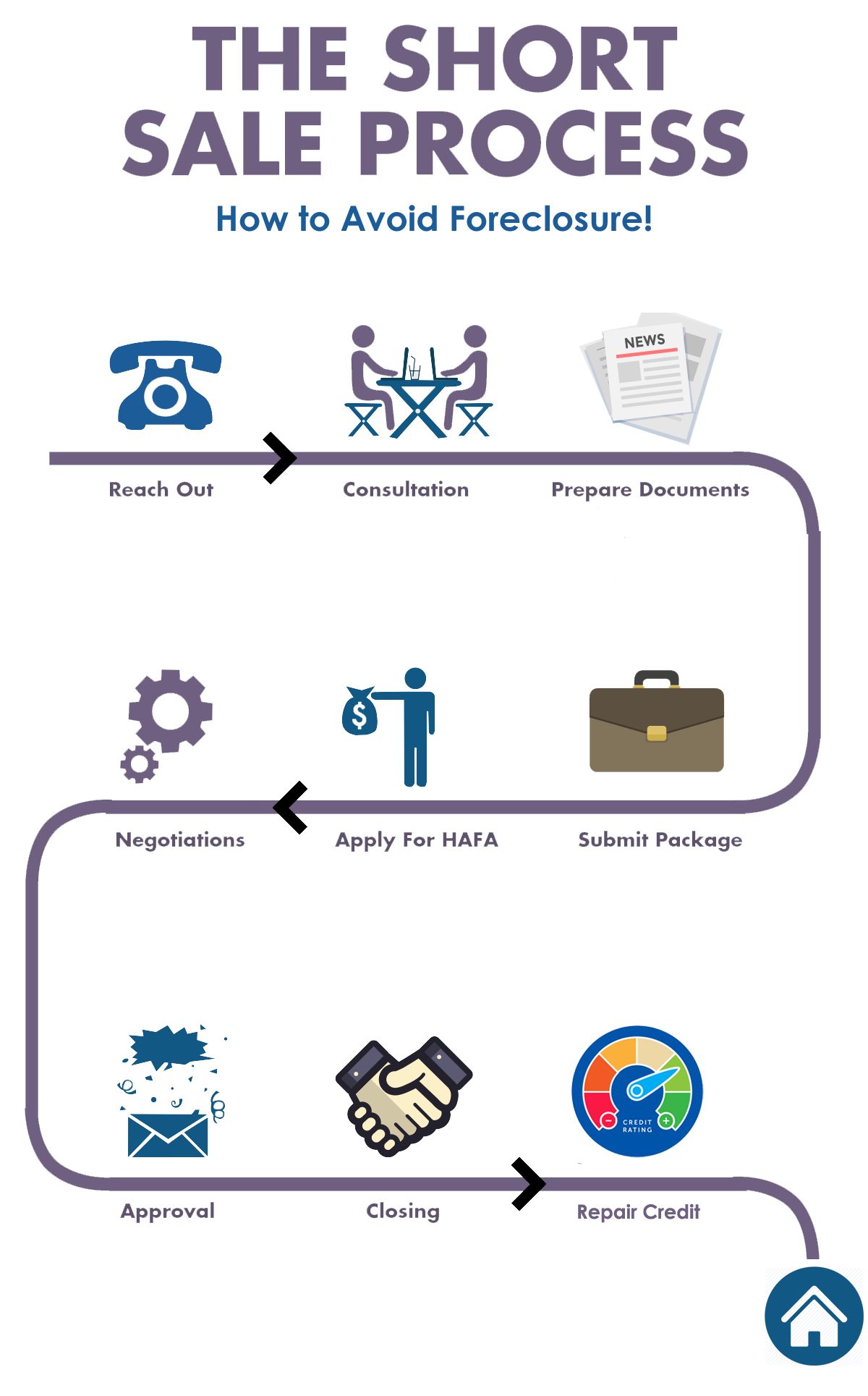

To be approved for a short sale, you’ll most likely have to submit an official “loss mitigation” (foreclosure avoidance) application to your. You are attempting to negotiate a short sale because you cannot afford your mortgage. Contact your loan servicer early on.

It is highly unlikely that an offer. In a short sale, the bank does not own the home and cannot accept offers or control the sale, but the bank has the final say on if they will accept a lower amount than what. One way to avoid foreclosure is with a loss mitigation option called a short sale, where you sell your home for less than what you owe on it.

2451 price st #b montgomery, al 36111. Up to 25% cash back assuming your state doesn't have a law prohibiting a deficiency judgment following a short sale, you might be able to avoid having to pay back a deficiency by. Any type of property sale that is marked as “not paid as agreed” harms your credit score.

/real-estate-short-sale_final-10164f91f4794facbd92a4dd21986984.png)